From the Detroit News online:

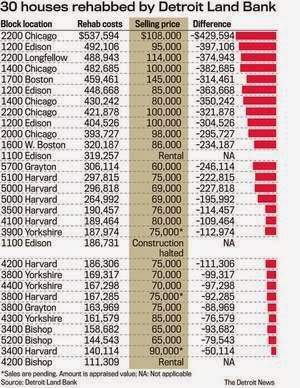

City officials spent as much as $537,000 per home renovating 30 houses under a federal program to fight blight only to sell most for less than $100,000 apiece, a Detroit News investigation has found.

The Detroit Land Bank transformed eyesores — some that were rotting and burned — into gleaming gems, with glass-tiled bathrooms, stainless steel appliances, underground sprinkler systems and even $35,000 geothermal heating in a few. The goal was to entice middle-class families into East English Village and Boston Edison to strengthen the neighborhoods...

In total, the land bank spent nearly $8.7 million from the U.S. Department of Housing and Urban Development on 30 homes. That’s an average of $290,000 per home, and the 13 most expensive homes cost $300,000 to $537,000 apiece. The return on the investment from sales so far: $2 million.

The money was spent under a former director, Aundra Wallace, who left last summer for an economic development job in Florida. He didn’t return phone calls for comment. His successor, along with Mayor Mike Duggan, have distanced themselves from the program and instead are auctioning homes to buyers who will make repairs themselves...

----

Link: http://www.detroitnews.com/article/20140529/METRO01/305290038/0/metro08/Detroit-spends-8-7-million-flip-30-homes-bring-2-million

Cut your costs. Save huge amounts of money. We call it: Refinance Your Investments®. We show you how to win freedom from Wall Street: replace what you own with the lowest cost ETFs. Then keep those ETFs for life.

Friday, May 30, 2014

The most sought-after homes still underwater

From Diana Olick at CNBC.com:

Buyers looking for affordable homes aren't finding much in today's housing market.

While investors snatched up most foreclosures, another after effect of the crash is keeping supply short: negative equity.

Nearly 10 million borrowers still owe more on mortgages than their homes are currently worth, according to Zillow.

That has kept them stuck in place.

As home prices rise, the nation's negative equity or "underwater" rate is falling overall, but affordable homes are still drowning disproportionately.

They are three times more likely to be underwater than expensive homes, according to Zillow...

----

Link: http://www.cnbc.com/id/101685441

Buyers looking for affordable homes aren't finding much in today's housing market.

While investors snatched up most foreclosures, another after effect of the crash is keeping supply short: negative equity.

Nearly 10 million borrowers still owe more on mortgages than their homes are currently worth, according to Zillow.

That has kept them stuck in place.

As home prices rise, the nation's negative equity or "underwater" rate is falling overall, but affordable homes are still drowning disproportionately.

They are three times more likely to be underwater than expensive homes, according to Zillow...

----

Link: http://www.cnbc.com/id/101685441

Monday, May 26, 2014

Housing's Missing Link: First-Time Buyers

From the Wall Street Journal online:

Economists, real-estate agents and many home builders expected first-time and entry-level buyers to begin returning to the market this year, jump-starting the sputtering housing recovery.

So far, that hasn't happened.

Less buying at the market's lower end by first-time buyers has contributed to limiting sales of existing homes so far this year to a pace of roughly 88% of their 10-year average.

It's also a factor in stunting sales of newly built homes to a pace of roughly 60% of their annual average since 2000.

Some economists now predict that tight lending standards, high prices and the sluggish economic recovery will keep first-timers from returning in full force for several years.

That likely means a slower pace for the housing recovery, already a drag on the broader economy in the past year...

Myriad other factors have dogged first-time buyers in recent years.

According to Census data, Americans from 25 to 34 years of age experienced the biggest decline in income—9%—of any age group from 2007 to 2012 other than people younger than 25. Many also are grappling with student debt that crimps their cash flow.

What's more, there are fewer affordable homes available for first-timers to purchase.

Nationally, the median price of an existing home has increased by 5.2% in the past year to $201,700. The median price of a newly built home registered $275,800 in April, down 1% from a year earlier...

----

Link:http://online.wsj.com/news/articles/SB10001424052702304479704579579792502256878?

Economists, real-estate agents and many home builders expected first-time and entry-level buyers to begin returning to the market this year, jump-starting the sputtering housing recovery.

So far, that hasn't happened.

Less buying at the market's lower end by first-time buyers has contributed to limiting sales of existing homes so far this year to a pace of roughly 88% of their 10-year average.

It's also a factor in stunting sales of newly built homes to a pace of roughly 60% of their annual average since 2000.

Some economists now predict that tight lending standards, high prices and the sluggish economic recovery will keep first-timers from returning in full force for several years.

That likely means a slower pace for the housing recovery, already a drag on the broader economy in the past year...

Myriad other factors have dogged first-time buyers in recent years.

According to Census data, Americans from 25 to 34 years of age experienced the biggest decline in income—9%—of any age group from 2007 to 2012 other than people younger than 25. Many also are grappling with student debt that crimps their cash flow.

What's more, there are fewer affordable homes available for first-timers to purchase.

Nationally, the median price of an existing home has increased by 5.2% in the past year to $201,700. The median price of a newly built home registered $275,800 in April, down 1% from a year earlier...

----

Link:http://online.wsj.com/news/articles/SB10001424052702304479704579579792502256878?

Sunday, May 25, 2014

Detroit News: Suburbs gain while Detroit population drops below 700,000

From DetroitNews.com:

The 60-year exodus from Detroit is continuing but may be slowing, as the city’s population has fallen under 700,000 residents, according to estimates ... by the U.S. Census Bureau.

The government pegs the city’s population at 688,701 as of summer 2013, down nearly 10,000 residents from 2012...

...Detroit, which had 1.9 million residents in 1950 and is now smaller than it was at any point since before 1920.

----

Link: http://www.detroitnews.com/article/20140521/METRO08/305210136/Suburbs-gain-while-Detroit-population-drops-below-700-000

The 60-year exodus from Detroit is continuing but may be slowing, as the city’s population has fallen under 700,000 residents, according to estimates ... by the U.S. Census Bureau.

The government pegs the city’s population at 688,701 as of summer 2013, down nearly 10,000 residents from 2012...

...Detroit, which had 1.9 million residents in 1950 and is now smaller than it was at any point since before 1920.

----

Link: http://www.detroitnews.com/article/20140521/METRO08/305210136/Suburbs-gain-while-Detroit-population-drops-below-700-000

Saturday, May 24, 2014

Inflation Can Be Seen Everywhere, But Is Acknowledged Nowhere

From Peter Schiff writing at RealClearMarkets.com:

Rising food prices are a major problem for many Americans struggling to make ends meet in our listless economy.

Exactly how much more pain does the Federal Reserve want to inflict on the middle and lower classes before it relents and stops creating even more inflation?

There is a growing belief among economists, highlighted in a recent debate I had with Nouriel Roubini, that higher prices are actually a benefit to consumers. They believe that the growth created by inflation is worth more than the cost imposed at check-out lines.

Instead, we are simply getting another dose of 1970s-style stagflation as higher prices simply amplify the pain of a stagnant economy and diminished employment opportunities.

The good news for Roubini and his ilk is that inflation does indeed help some people...the very rich.

I have long argued that Fed stimulus and quantitative easing only result in the formation of asset bubbles that unevenly favor the rich, while misdirecting capital away from savings and productive investments that would benefit everyone else.

Economists had blamed the recent disappointments from mass-market retailers like Walmart, Target, Best Buy, Staples, Dick's Sporting Goods, and Pet Smart (to name but a few) on the ravages of winter weather rather than weak fundamentals.

But yesterday the upscale vendor Tiffany's issued a boffo report that showed net income up an astounding 50% over first quarter in 2013. The rich seemed to have little trouble braving the elements to buy baubles on Fifth Avenue, yet average Americans were too thin-skinned to make it to Dick's Sporting Goods.

While the world talks about the dangers of deflation, which offers no harm to economies or consumers, actual inflation is everywhere to be seen and nowhere acknowledged.

Instead, we get a universal agreement that the middle class must continue to suffer so that the Fed and financial speculators can continue to revel in the charade.

----

Link: http://www.realclearmarkets.com/articles/2014/05/23/inflation_is_everywhere_to_be_seen_and_nowhere_acknowledged_101073.html

Rising food prices are a major problem for many Americans struggling to make ends meet in our listless economy.

Exactly how much more pain does the Federal Reserve want to inflict on the middle and lower classes before it relents and stops creating even more inflation?

There is a growing belief among economists, highlighted in a recent debate I had with Nouriel Roubini, that higher prices are actually a benefit to consumers. They believe that the growth created by inflation is worth more than the cost imposed at check-out lines.

Instead, we are simply getting another dose of 1970s-style stagflation as higher prices simply amplify the pain of a stagnant economy and diminished employment opportunities.

The good news for Roubini and his ilk is that inflation does indeed help some people...the very rich.

I have long argued that Fed stimulus and quantitative easing only result in the formation of asset bubbles that unevenly favor the rich, while misdirecting capital away from savings and productive investments that would benefit everyone else.

Economists had blamed the recent disappointments from mass-market retailers like Walmart, Target, Best Buy, Staples, Dick's Sporting Goods, and Pet Smart (to name but a few) on the ravages of winter weather rather than weak fundamentals.

But yesterday the upscale vendor Tiffany's issued a boffo report that showed net income up an astounding 50% over first quarter in 2013. The rich seemed to have little trouble braving the elements to buy baubles on Fifth Avenue, yet average Americans were too thin-skinned to make it to Dick's Sporting Goods.

While the world talks about the dangers of deflation, which offers no harm to economies or consumers, actual inflation is everywhere to be seen and nowhere acknowledged.

Instead, we get a universal agreement that the middle class must continue to suffer so that the Fed and financial speculators can continue to revel in the charade.

----

Link: http://www.realclearmarkets.com/articles/2014/05/23/inflation_is_everywhere_to_be_seen_and_nowhere_acknowledged_101073.html

Wednesday, May 21, 2014

China has blacklisted Microsoft Windows - 90% are likely illegal copies anyway

From CNN online:

The prohibition doesn't affect the Chinese public -- only government computers...

Windows operating systems are huge in China, and now that Microsoft has ended support for Windows XP, the Chinese government finds itself in a tough spot.

Nearly three-quarters of Chinese PCs are running XP. That leaves tens of millions of computers there at risk of bugs and malware...

Microsoft is also fighting an ongoing piracy battle in China.

The company estimates 90% of Chinese PCs are running illegal copies of Windows software.

----

Link: http://money.cnn.com/2014/05/20/technology/china-windows-8/index.html

The prohibition doesn't affect the Chinese public -- only government computers...

Windows operating systems are huge in China, and now that Microsoft has ended support for Windows XP, the Chinese government finds itself in a tough spot.

Nearly three-quarters of Chinese PCs are running XP. That leaves tens of millions of computers there at risk of bugs and malware...

Microsoft is also fighting an ongoing piracy battle in China.

The company estimates 90% of Chinese PCs are running illegal copies of Windows software.

----

Link: http://money.cnn.com/2014/05/20/technology/china-windows-8/index.html

Tuesday, May 20, 2014

10 Million Homes still Underwater

From the Wall Street Journal online:

Nearly 10 million U.S. households remain stuck in homes worth less than their mortgage and

a similar number have so little equity they can't meet the expenses of selling a home, trends that help explain recent sluggishness in the housing recovery.

At the end of the first quarter, some 18.8% of U.S. homeowners with a mortgage—9.7 million households—were "underwater" on their mortgage, according to a report scheduled for release Tuesday by real-estate information site Zillow Inc.

While that is an improvement from 19.4% at the end of last year and a peak of 31.4% 2012, those figures understate the problem.

In addition to the homeowners who are underwater, roughly 10 million households have 20% or less equity in their homes, which makes it difficult for them to sell their homes without dipping into their savings.

Most move-up homeowners typically use their home equity to cover broker fees, closing costs and a down payment for their next home. Without those funds, many homeowners can't sell...

----

Link: http://online.wsj.com/news/articles/SB10001424052702304422704579572261754798636?

Nearly 10 million U.S. households remain stuck in homes worth less than their mortgage and

a similar number have so little equity they can't meet the expenses of selling a home, trends that help explain recent sluggishness in the housing recovery.

At the end of the first quarter, some 18.8% of U.S. homeowners with a mortgage—9.7 million households—were "underwater" on their mortgage, according to a report scheduled for release Tuesday by real-estate information site Zillow Inc.

While that is an improvement from 19.4% at the end of last year and a peak of 31.4% 2012, those figures understate the problem.

In addition to the homeowners who are underwater, roughly 10 million households have 20% or less equity in their homes, which makes it difficult for them to sell their homes without dipping into their savings.

Most move-up homeowners typically use their home equity to cover broker fees, closing costs and a down payment for their next home. Without those funds, many homeowners can't sell...

----

Link: http://online.wsj.com/news/articles/SB10001424052702304422704579572261754798636?

Sunday, May 18, 2014

Reversing American Decline -- Inequality is just a symptom. What we need is growth.

From Joel Kotkin writing online at the nydailynews.com:

Across broad ideological lines, Americans now foresee a dismal, downwardly mobile future for the country’s middle and working classes.

While previous generations generally did far better than their predecessors, those in the current one, outside the very rich, are locked in a struggle to carve out the economic opportunities and access to property that had become accepted norms here over the past century...

This has allowed Obama, de Blasio and others shape a new conversation centered on inequality, rather than growth.

Oddly enough, it’s a model that relies on Europe’s example even as the continent’s own economic prospects appear dismal, and mainstream political parties there are registering their lowest levels of popular support in decades....

Sparking beneficial economic growth requires a shift in priorities, and thus presents a challenge to the new class order dominated by Wall Street, the tech oligarchy and their partners in the Clerisy.

It is not enough merely to blame the so-called 1%, but to shift the benefits of growth away from the current hegemons, notably in the very narrow finance and high-tech sectors, and towards those involved in a broad array of productive enterprise.

The American economy’s capacity for renewal remains much greater than widely believed.

Rather than a permanent condition of slow growth, the United States could be on the cusp of another period of broad-based expansion, spurred in part by its rapidly growing natural gas and oil production — a once-in-a-lifetime opportunity as cheap and abundant natural gas is luring investment from manufacturers from Europe and Asia, and providing good-paying American jobs.

This, along with growth in manufacturing, could spark better times for the middle class, as would the re-igniting of single-family home construction.

If America really wants to confront its growing class divide, it needs to spark such broad-based economic growth, rather than simply feathering the nests of the already rich, privileged and well-connected.

----

Link: http://www.nydailynews.com/opinion/reversing-american-decline-article-1.1796369

Across broad ideological lines, Americans now foresee a dismal, downwardly mobile future for the country’s middle and working classes.

While previous generations generally did far better than their predecessors, those in the current one, outside the very rich, are locked in a struggle to carve out the economic opportunities and access to property that had become accepted norms here over the past century...

This has allowed Obama, de Blasio and others shape a new conversation centered on inequality, rather than growth.

Oddly enough, it’s a model that relies on Europe’s example even as the continent’s own economic prospects appear dismal, and mainstream political parties there are registering their lowest levels of popular support in decades....

Sparking beneficial economic growth requires a shift in priorities, and thus presents a challenge to the new class order dominated by Wall Street, the tech oligarchy and their partners in the Clerisy.

It is not enough merely to blame the so-called 1%, but to shift the benefits of growth away from the current hegemons, notably in the very narrow finance and high-tech sectors, and towards those involved in a broad array of productive enterprise.

The American economy’s capacity for renewal remains much greater than widely believed.

Rather than a permanent condition of slow growth, the United States could be on the cusp of another period of broad-based expansion, spurred in part by its rapidly growing natural gas and oil production — a once-in-a-lifetime opportunity as cheap and abundant natural gas is luring investment from manufacturers from Europe and Asia, and providing good-paying American jobs.

This, along with growth in manufacturing, could spark better times for the middle class, as would the re-igniting of single-family home construction.

If America really wants to confront its growing class divide, it needs to spark such broad-based economic growth, rather than simply feathering the nests of the already rich, privileged and well-connected.

----

Link: http://www.nydailynews.com/opinion/reversing-american-decline-article-1.1796369

Thursday, May 15, 2014

More Detroits Are on the Way

From the Wall Street Journal online:

The consequences of our state and municipal fiscal crises are plain: We are drastically underinvesting in physical infrastructure—roads, bridges, ports, etc.—the necessary underpinning of future growth.

Just as important, we are also underinvesting in human infrastructure, most notably our children's ability to compete...

Permitting states and municipalities to continue these practices will result—indeed, has already begun to result—in harmful service cuts and a failure to fund promises made to creditors, public employees and the beneficiaries of essential public services, including elderly people without minimal levels of financial support.

What this means is we can expect to see more Detroits.

Last July the Motor City filed the country's largest municipal bankruptcy after racking up $18 billion in promises it could no longer afford to keep...

----

Link: http://online.wsj.com/news/articles/SB10001424052702304101504579546263639995456?

The consequences of our state and municipal fiscal crises are plain: We are drastically underinvesting in physical infrastructure—roads, bridges, ports, etc.—the necessary underpinning of future growth.

Just as important, we are also underinvesting in human infrastructure, most notably our children's ability to compete...

Permitting states and municipalities to continue these practices will result—indeed, has already begun to result—in harmful service cuts and a failure to fund promises made to creditors, public employees and the beneficiaries of essential public services, including elderly people without minimal levels of financial support.

What this means is we can expect to see more Detroits.

Last July the Motor City filed the country's largest municipal bankruptcy after racking up $18 billion in promises it could no longer afford to keep...

----

Link: http://online.wsj.com/news/articles/SB10001424052702304101504579546263639995456?

Monday, May 12, 2014

The Mysterious Death of Entrepreneurship in America

From The Atlantic online:

For entrepreneurs in America, it is the best of times, and it is the worst of times. It is "the age of the start-up," and "American entrepreneurship is plummeting..."

Tech valuations are soaring, and tech valuations are collapsing, and tech valuations are irrelevant. "A million users" has never been more attainable, and "a million users" has never been more meaningless.

It is the spring of hope. It is the winter of despair...

...researchers studying national entrepreneurship trends aren't caught staring at the tip of the iceberg.

When they describe "declining business dynamism" (at Brookings) and steadily falling entrepreneurship (at BLS), they're looking at the whole block of ice. And it's melting.

What's melting, exactly? Not the kids' apps, but the mom-and-pop stores. Derek's Coffee and Thompson's Corner Store would be considered start-ups.

But a new Starbucks or Whole Foods is considered part of an existing franchise. So as chains have expanded by more than 50 percent since 1983 ... start-ups have perished...

The demise of small new companies isn't limited to retail. Construction and manufacturing start-ups have collapsed by more than 60 percent in the last four decades...

So there are fewer new companies, and a lot more Dunkin Donuts.

Why should you care?

One good reason to care about start-ups in America is that they tend to start ... in ... America...

The vast majority of job creation at big multinational corporations—as much as 75 percent of new jobs—happens overseas, since other countries are growing considerably faster than our 2-percent rate.

One paradox of globalization is that it's localized employment.

Since big companies off-shore much of their job growth (or replace what's left of it with software or smart hardware), the future of work in the U.S. will come from work that absolutely has to be here, like health care, education, and food services.

----

Link: http://www.theatlantic.com/business/archive/2014/05/entrepreneurship-in-america-is-dying-wait-what-does-that-actually-mean/362097/

For entrepreneurs in America, it is the best of times, and it is the worst of times. It is "the age of the start-up," and "American entrepreneurship is plummeting..."

Tech valuations are soaring, and tech valuations are collapsing, and tech valuations are irrelevant. "A million users" has never been more attainable, and "a million users" has never been more meaningless.

It is the spring of hope. It is the winter of despair...

...researchers studying national entrepreneurship trends aren't caught staring at the tip of the iceberg.

When they describe "declining business dynamism" (at Brookings) and steadily falling entrepreneurship (at BLS), they're looking at the whole block of ice. And it's melting.

What's melting, exactly? Not the kids' apps, but the mom-and-pop stores. Derek's Coffee and Thompson's Corner Store would be considered start-ups.

But a new Starbucks or Whole Foods is considered part of an existing franchise. So as chains have expanded by more than 50 percent since 1983 ... start-ups have perished...

The demise of small new companies isn't limited to retail. Construction and manufacturing start-ups have collapsed by more than 60 percent in the last four decades...

So there are fewer new companies, and a lot more Dunkin Donuts.

Why should you care?

One good reason to care about start-ups in America is that they tend to start ... in ... America...

The vast majority of job creation at big multinational corporations—as much as 75 percent of new jobs—happens overseas, since other countries are growing considerably faster than our 2-percent rate.

One paradox of globalization is that it's localized employment.

Since big companies off-shore much of their job growth (or replace what's left of it with software or smart hardware), the future of work in the U.S. will come from work that absolutely has to be here, like health care, education, and food services.

----

Link: http://www.theatlantic.com/business/archive/2014/05/entrepreneurship-in-america-is-dying-wait-what-does-that-actually-mean/362097/

Saturday, May 10, 2014

NYT: The Older Cling to Jobs, Crowding Out the Younger

From the New York Times online:

In general, the older the group, the more likely it has been to hold onto jobs through the recession and recovery.

In every age group above 62, the proportion of both men and women who are employed is higher than it was before the recession.

Much of that change probably does not involve people getting new jobs, but instead shows that those with jobs are more reluctant to retire than their predecessors were before the recession.

Such people may have greater fears about paying for retirement, reflecting both the fall in home prices during the downturn and the declining presence of defined-benefit pension plans.

Even those with substantial savings may be concerned, with interest rates so low, that they can earn little on their savings without taking on significant amounts of risk.

Those decisions collectively may be having a crowding-out effect on younger workers, by not freeing up jobs that could prompt promotions for some and new hiring to replace those who were promoted...

----

Link: http://www.nytimes.com/2014/05/10/business/economy/the-older-cling-to-jobs-crowding-out-the-younger.html?

In general, the older the group, the more likely it has been to hold onto jobs through the recession and recovery.

In every age group above 62, the proportion of both men and women who are employed is higher than it was before the recession.

Much of that change probably does not involve people getting new jobs, but instead shows that those with jobs are more reluctant to retire than their predecessors were before the recession.

Such people may have greater fears about paying for retirement, reflecting both the fall in home prices during the downturn and the declining presence of defined-benefit pension plans.

Even those with substantial savings may be concerned, with interest rates so low, that they can earn little on their savings without taking on significant amounts of risk.

Those decisions collectively may be having a crowding-out effect on younger workers, by not freeing up jobs that could prompt promotions for some and new hiring to replace those who were promoted...

----

Link: http://www.nytimes.com/2014/05/10/business/economy/the-older-cling-to-jobs-crowding-out-the-younger.html?

Thursday, May 8, 2014

Middle-Income Wage, Not The Minimum, Needs To Be Raised

From Rand Paul and Stephen Moore writing at Investors.com:

For the vast majority of workers, the problem isn't a flat minimum wage, it's a declining middle-class paycheck.

The minimum wage affects only, at most, 5% of workers — and almost half of them are in starter jobs or are teenagers. What about the other 95% — especially those working parents with children?

These are the people who desperately need a raise.

According to statistics from Sentier Research, based on monthly Census Bureau data, the median household income is still some $4,000 lower today than it was before the recession began in 2008, and about $2,000 lower than it was since the recovery began in June of 2009.

Usually periods of recovery from a financial meltdown are years when workers rapidly make up the lost ground in income and job opportunities surrendered during recession.

In this case, average workers have continued to lose ground. This explains why more than half of workers think the recession never ended. For them, it hasn't....

----

Link: http://news.investors.com/ibd-editorials-perspective/050714-700012-falling-middle-class-incomes-bigger-problem-than-minimum-wage.htm

For the vast majority of workers, the problem isn't a flat minimum wage, it's a declining middle-class paycheck.

The minimum wage affects only, at most, 5% of workers — and almost half of them are in starter jobs or are teenagers. What about the other 95% — especially those working parents with children?

These are the people who desperately need a raise.

According to statistics from Sentier Research, based on monthly Census Bureau data, the median household income is still some $4,000 lower today than it was before the recession began in 2008, and about $2,000 lower than it was since the recovery began in June of 2009.

Usually periods of recovery from a financial meltdown are years when workers rapidly make up the lost ground in income and job opportunities surrendered during recession.

In this case, average workers have continued to lose ground. This explains why more than half of workers think the recession never ended. For them, it hasn't....

----

Link: http://news.investors.com/ibd-editorials-perspective/050714-700012-falling-middle-class-incomes-bigger-problem-than-minimum-wage.htm

Amity Shlaes: The Minimum Wage Makes Depressions Worse

Amity Shlaes writing at the National Review online:

Joe Biden thinks it helped end the Great Depression. It actually extended it.

The vice president has it exactly backward.

Many of us have always suspected that upward pressure on wages in the 1930s can’t have made it easier to hire.

But only lately, in the last 10 or 15 years, has newer research formed a complete picture of what happened in the 1930s.

It seems that the policy of upward pressure on wages, which is the idea of the minimum wage, made the Depression worse.

Here’s what happened. Back in the teens and ’20s, an era of technocrats and progressives, employers dropped wages in downturns — heck, that was better than laying people off. But employers wondered aloud whether higher wages would be good for business.

The most famous of these was Henry Ford, who paid above market level on the theory that workers would use any extra money to “buy back the car.” In an individual business this can be true, especially when that business is simultaneously introducing technology, such as the Ford assembly line, that radically increases productivity...

President Herbert Hoover liked the idea enough that within months of the 1929 crash he hauled business leaders to Washington to browbeat them into sustaining higher wages...

Franklin Roosevelt codified the pressure further with the National Industrial Recovery Act, whose codes contained minimum wages for various trades. Now even private companies that were not government contractors had to pay more than they could afford.

...within months Roosevelt signed the Wagner Act, which gave labor the power to terrify closed-shop business and even carry out occupations of business premises (this latter action bearing the euphemism “sit-down strike”). Employers offered higher wages or paid for their refusal with violent strikes. John L. Lewis, the militant labor leader, terrified even Ford into accepting unionization.

As if the Wagner Act were not enough, a new law, the Fair Labor Standards Act of 1938, re-codified the minimum wage across trades.

The result, as scholars Lee Ohanian, Harold Cole, and others have discovered, is a tragic perversity.

In a depression, when employers were losing money, wages were too high... Reducing wages, the old lesser evil chosen by employers in troubled times, would not be sanctioned by the powerful New Dealers in Washington.

So employers often laid people off — hence the mostly double-digit unemployment of the 1930s.

Vice President Biden’s choice of 1938 as subject is no accident. In the very late 1930s, unemployment did drop, though not down to anywhere near acceptable levels. If you want, you can tell yourself this drop was caused by the 1938 Fair Labor Standards Act. But this drop came in good part because the New Deal was running out of steam.

...the record from the Great Depression suggests that upward pressure on wages really can hurt the country. Seriously.

— Amity Shlaes chairs the board of the Calvin Coolidge Presidential Foundation.

----

Link: http://www.nationalreview.com/article/377435/minimum-wage-makes-depressions-worse-amity-shlaes

Joe Biden thinks it helped end the Great Depression. It actually extended it.

The vice president has it exactly backward.

Many of us have always suspected that upward pressure on wages in the 1930s can’t have made it easier to hire.

But only lately, in the last 10 or 15 years, has newer research formed a complete picture of what happened in the 1930s.

It seems that the policy of upward pressure on wages, which is the idea of the minimum wage, made the Depression worse.

Here’s what happened. Back in the teens and ’20s, an era of technocrats and progressives, employers dropped wages in downturns — heck, that was better than laying people off. But employers wondered aloud whether higher wages would be good for business.

The most famous of these was Henry Ford, who paid above market level on the theory that workers would use any extra money to “buy back the car.” In an individual business this can be true, especially when that business is simultaneously introducing technology, such as the Ford assembly line, that radically increases productivity...

President Herbert Hoover liked the idea enough that within months of the 1929 crash he hauled business leaders to Washington to browbeat them into sustaining higher wages...

Franklin Roosevelt codified the pressure further with the National Industrial Recovery Act, whose codes contained minimum wages for various trades. Now even private companies that were not government contractors had to pay more than they could afford.

...within months Roosevelt signed the Wagner Act, which gave labor the power to terrify closed-shop business and even carry out occupations of business premises (this latter action bearing the euphemism “sit-down strike”). Employers offered higher wages or paid for their refusal with violent strikes. John L. Lewis, the militant labor leader, terrified even Ford into accepting unionization.

As if the Wagner Act were not enough, a new law, the Fair Labor Standards Act of 1938, re-codified the minimum wage across trades.

The result, as scholars Lee Ohanian, Harold Cole, and others have discovered, is a tragic perversity.

In a depression, when employers were losing money, wages were too high... Reducing wages, the old lesser evil chosen by employers in troubled times, would not be sanctioned by the powerful New Dealers in Washington.

So employers often laid people off — hence the mostly double-digit unemployment of the 1930s.

Vice President Biden’s choice of 1938 as subject is no accident. In the very late 1930s, unemployment did drop, though not down to anywhere near acceptable levels. If you want, you can tell yourself this drop was caused by the 1938 Fair Labor Standards Act. But this drop came in good part because the New Deal was running out of steam.

...the record from the Great Depression suggests that upward pressure on wages really can hurt the country. Seriously.

— Amity Shlaes chairs the board of the Calvin Coolidge Presidential Foundation.

----

Link: http://www.nationalreview.com/article/377435/minimum-wage-makes-depressions-worse-amity-shlaes

Tuesday, May 6, 2014

3 signs the economy's still hurting

From MSN Money online:

#1: Where are the jobs?

The drop in the unemployment rate was overwhelmingly driven by a whopping 806,000 decline in the labor force. That put the labor force participation rate at just 62.8 percent, a 35-year low. The employment-to-population ratio stood at 58.9 percent last month -- 0.5 percent below where it was when the recession ended in the summer of 2009.

#2: Global growth

Monday, we learned that the Global Manufacturing PMI measure of factory activity fell to a six-month low of 51.9 on a drop in new orders and production.

#3: Wage growth (or lack thereof)

And finally, and most importantly for beleaguered middle-class families, wage growth continues to lose momentum and remains well below the rates reached in the late 1990s and the mid-2000s.

----

Link: http://money.msn.com/top-stocks/post--3-signs-the-economys-still-hurting

#1: Where are the jobs?

The drop in the unemployment rate was overwhelmingly driven by a whopping 806,000 decline in the labor force. That put the labor force participation rate at just 62.8 percent, a 35-year low. The employment-to-population ratio stood at 58.9 percent last month -- 0.5 percent below where it was when the recession ended in the summer of 2009.

#2: Global growth

Monday, we learned that the Global Manufacturing PMI measure of factory activity fell to a six-month low of 51.9 on a drop in new orders and production.

#3: Wage growth (or lack thereof)

And finally, and most importantly for beleaguered middle-class families, wage growth continues to lose momentum and remains well below the rates reached in the late 1990s and the mid-2000s.

----

Link: http://money.msn.com/top-stocks/post--3-signs-the-economys-still-hurting

Saturday, May 3, 2014

A Nation of Temps and Burger Flippers?

From Bloomberg View:

Is the U.S. turning into a nation of temps, burger flippers and retail sales associates?

Not quite, but the quality of the jobs being created does leave much to be desired.

Today's employment report offered an encouraging sign that the recovery is shaking off a slow winter. Nonfarm payrolls grew by an estimated 288,000 jobs in April, bringing the one-year total to 2.4 million jobs...

That said, some sectors stand out: ...temporary help services, food services and drinking places, retail trade, and professional and technical services. Also notable are home health-care services (think taking care of Grandpa) and mining (the shale boom):

The prominence of temporary employment almost five years into the recovery isn’t a great sign.

It suggests that companies are hiring through employment services rather than putting new workers on their payrolls -- a practice that makes firing easier and reflects their caution about the economic outlook.

Promising as the gains in professional and technical services might sound, they might not bode well for employment elsewhere. A lot of the growth is in the areas of computer and management consultants -- that is, people who help businesses figure out how to make do with fewer workers.

All told, the data suggest employers are still hesitant to hire and are looking for ways to cut costs, while many employees are settling for whatever jobs are available. That's hardly the recovery we've all been waiting for.

----

Link: http://www.bloombergview.com/articles/2014-05-02/a-nation-of-temps-and-burger-flippers

Is the U.S. turning into a nation of temps, burger flippers and retail sales associates?

Not quite, but the quality of the jobs being created does leave much to be desired.

Today's employment report offered an encouraging sign that the recovery is shaking off a slow winter. Nonfarm payrolls grew by an estimated 288,000 jobs in April, bringing the one-year total to 2.4 million jobs...

That said, some sectors stand out: ...temporary help services, food services and drinking places, retail trade, and professional and technical services. Also notable are home health-care services (think taking care of Grandpa) and mining (the shale boom):

The prominence of temporary employment almost five years into the recovery isn’t a great sign.

It suggests that companies are hiring through employment services rather than putting new workers on their payrolls -- a practice that makes firing easier and reflects their caution about the economic outlook.

Promising as the gains in professional and technical services might sound, they might not bode well for employment elsewhere. A lot of the growth is in the areas of computer and management consultants -- that is, people who help businesses figure out how to make do with fewer workers.

All told, the data suggest employers are still hesitant to hire and are looking for ways to cut costs, while many employees are settling for whatever jobs are available. That's hardly the recovery we've all been waiting for.

----

Link: http://www.bloombergview.com/articles/2014-05-02/a-nation-of-temps-and-burger-flippers

Subscribe to:

Comments (Atom)